np-formalization

Searing, E. A., & Lecy, J. D. (2022). Growing Up Nonprofit: Predictors of Early-Stage Nonprofit Formalization.Nonprofit and Voluntary Sector Quarterly, 51(3), 680-698.

The nonprofit organizational life cycle literature has traditionally focused on the entry and exit processes; the intermediate organizational life stages between these bookends have received less attention. Almost half of all nonprofits at any given time operate in an early life stage with less than US$100,000 in revenue, minimal overhead spending, and no paid managers. This study examines the process by which nonprofits leave the small, informal, startup phase and begin the next life stage characterized by growth and formalization. We identify financial and organizational characteristics that predict whether the nonprofit will successfully transition out of the early and informal life stage. We find that investments in professional fundraising and access to government funds are predictive of the transition out of the start-up phase, while traditional financial predictors such as revenue concentration, equity ratio, fixed cost ratios, and the accumulation of unrestricted assets have modest to no effects.

FILES •

DATA

FILES •

DATA

REPLICATION CODE + DATA

- Step-01 Hazard Model Panel Construction

- Step-02 Model Specification

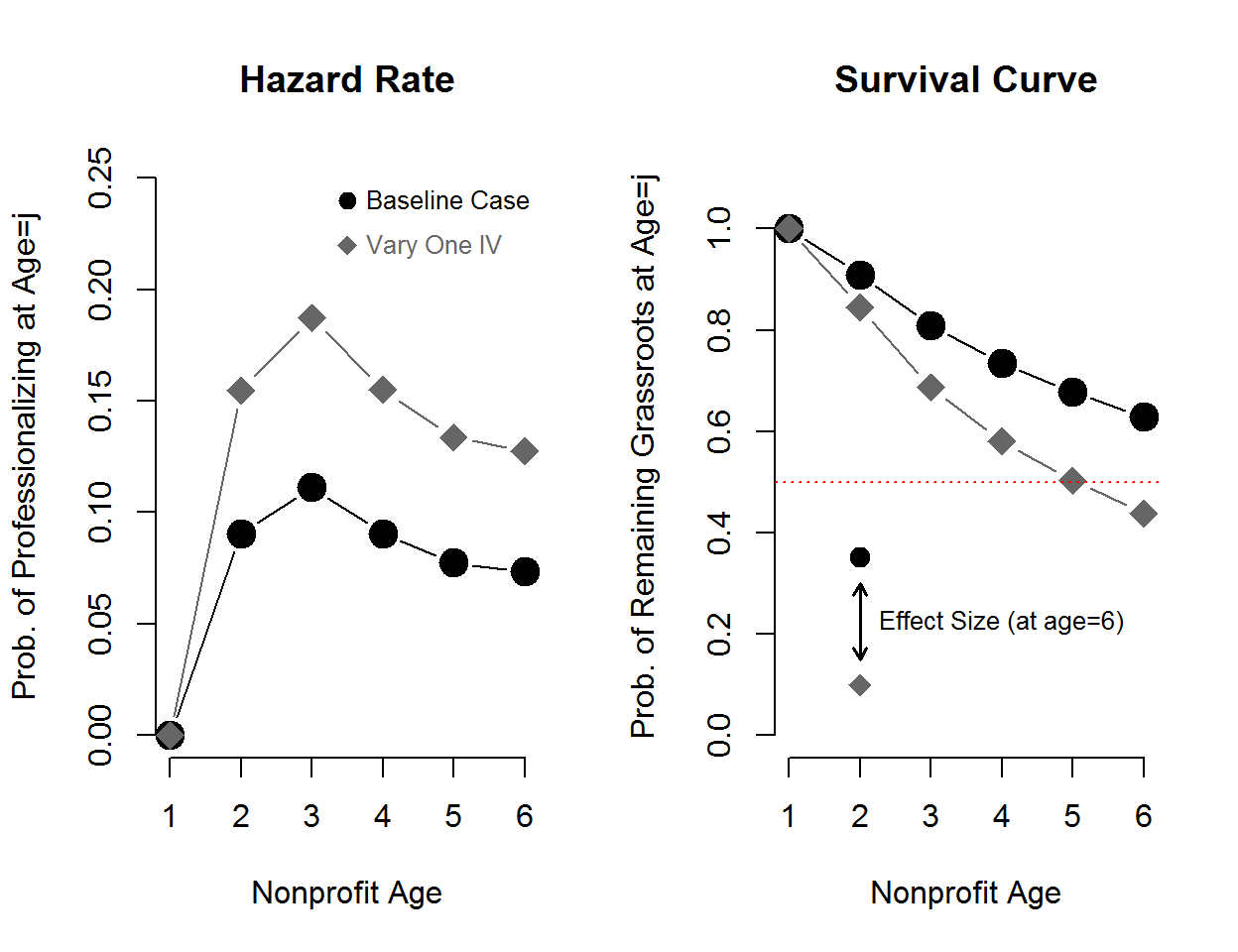

- Step-03 Generate Effect Sizes

- Step-04 Formatted Paper Graphs

Discuss

Key Findings:

Broadly, investment in managerial infrastructure is a strong indicator of commitment to growth. We observe that nonprofits which invest in fundraising and accounting capacity are more likely to successfully transition to the stage of formalization and expansion. Accrual accounting, on the contrary, is required to comply with requirements of several public and foundation revenue sources, but it is not as strong of a predictor as professional fundraising.

Financial slack is also a strong predictor of the transition to the formalization phase, but most prominently through the surplus ratio and much more modest for the equity ratio, fixed cost ratio, and UNAs. All have positive impacts on the likelihood of escaping the earlier life phase, but surplus ratio (UNAs) has one of the largest effects on the probability of entering the formalization stage in the full model (0.381), whereas the impact of the equity ratio (0.114), the fixed cost ratio (0.042), and UNAs (0.098) are approximately one quarter to one tenth as strong. Despite their importance in the literature, neither the equity ratio nor the percentage of fixed costs have a significant impact on more than half of the subsectors. This may be because these are typically measures of investment in things such as facilities and equipment, which might not be important or acquirable at this life stage for nonprofits. Similarly, an above-average endowment (UNAs) is consistently significant in the models across subsectors, but the impact is also consistently small (0.098).

On the revenue side, government grants also have a large and positive impact on formalization, a finding that is surprisingly uniform across sectors. This supports the findings of Kim and Bradach (2012) regarding the stabilizing effect of government funds, in addition to government’s general preference for formalization (Stewart & Faulk, 2014). The necessary development of institutional capacity and resources to manage government funding directly supports the logic of the formalization model.