Current Ratio

Definition & Interpretation

\[Current \: Asset \: Ratio = \frac{Current \: Assets}{Current \: Liabilities}\]

The current ratio is used to measure the overall liquidity of a nonprofit organization.

In its simplest form, it shows how many dollars of current assets an organization has to cover its current obligations. The higher the ratio, the more liquid the organization.

As a rule of thumb, organizations should strive for a current ratio of 1.0 or higher. An organization with a ratio of 1.0 would have one dollar of assets to pay for every dollar of current liabilities.

Variables

Numerator: (Cash + short-term investments + current receivables + inventories + prepaid expenses)

- On 990: (Part X, line 1B) + (Part X, line 2B) + (Part X, line 3B) +

(Part X, line 4B) + (Part X, line 8B) + (Part X, line 9B)

- SOI PC EXTRACTS: nonintcashend, svngstempinvend,pldgegrntrcvblend,

accntsrcvblend, invntriesalesend, prepaidexpnsend

- On EZ: Part I, line 22 [cash and short-term investments only]

Denominator: (Accounts payable + grants payable)

- On 990: (Part X, line 17B) + (Part X, line 18B)

- SOI PC EXTRACTS: accntspayableend+grntspayableend

- On EZ: Not available

Note: This data is only available for organizations that file a full 990, not for EZ filers.

Note: The EZ form only asks filers to report on cash, savings and investments; all receivable accounts, inventories, and prepaid expenses are reported in the line item “other assets” (Part II, line 24), and details are reported in Schedule O. Similarly, the EZ form asks filers to report on total liabilities, with details about payable accounts reported in Schedule O.

liquidity <- ( core$nonintcashend + core$svngstempinvend +

core$pldgegrntrcvblend + core$accntsrcvblend +

core$invntriesalesend + core$prepaidexpnsend )

# can't divide by zero

payables <- ( core$accntspayableend + core$grntspayableend )

payables[ payables == 0 ] <- NA

core$currentratio <- liquidity / payables

# summary( core$currentratio )Standardize Scales

Check high and low values to see what makes sense.

x.05 <- quantile( core$currentratio, 0.05, na.rm=T )

x.95 <- quantile( core$currentratio, 0.95, na.rm=T )

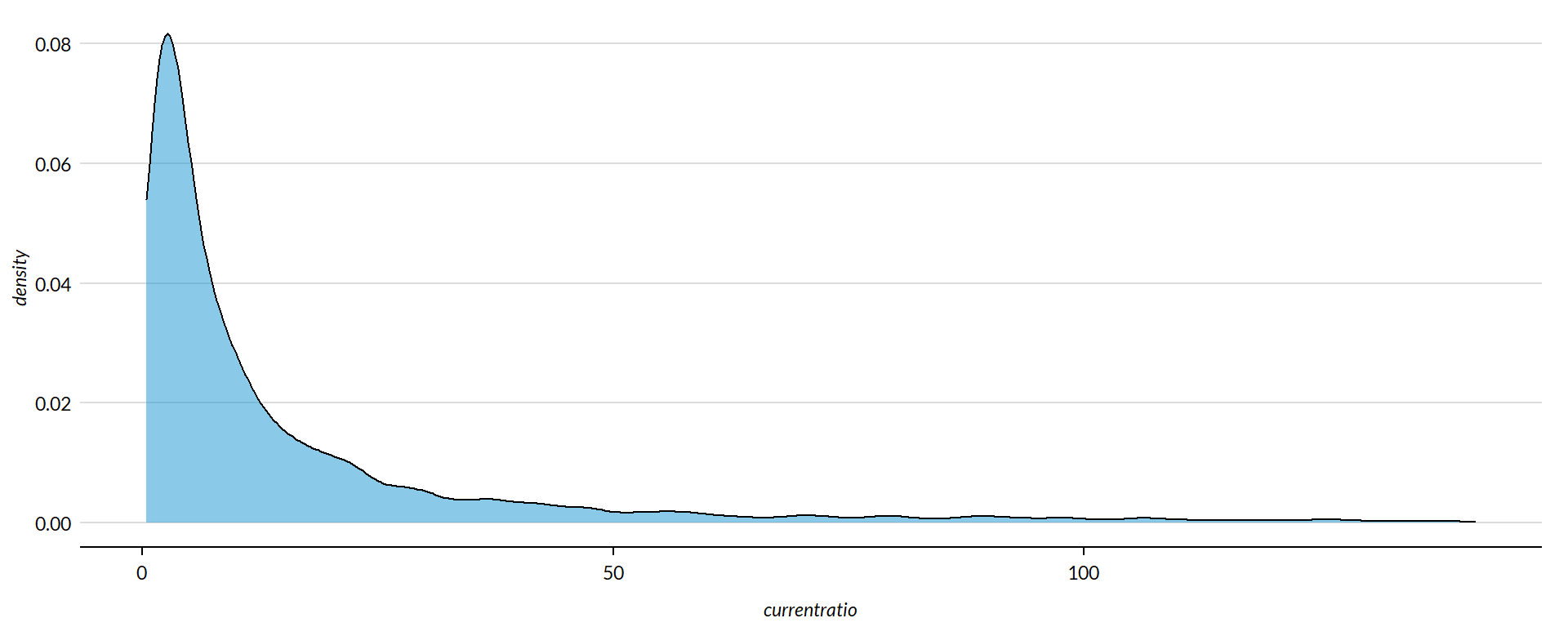

ggplot( core, aes(x = currentratio ) ) +

geom_density( alpha = 0.5) +

xlim( x.05, x.95 )

core2 <- core

# proportion of values that are negative

mean( core2$currentratio < 0, na.rm=T )

## [1] 0.002959205

core2$currentratio[ core2$currentratio < 0 ] <- 0

# proption of values above 200%

mean( core2$currentratio > 200, na.rm=T )

## [1] 0.03804692

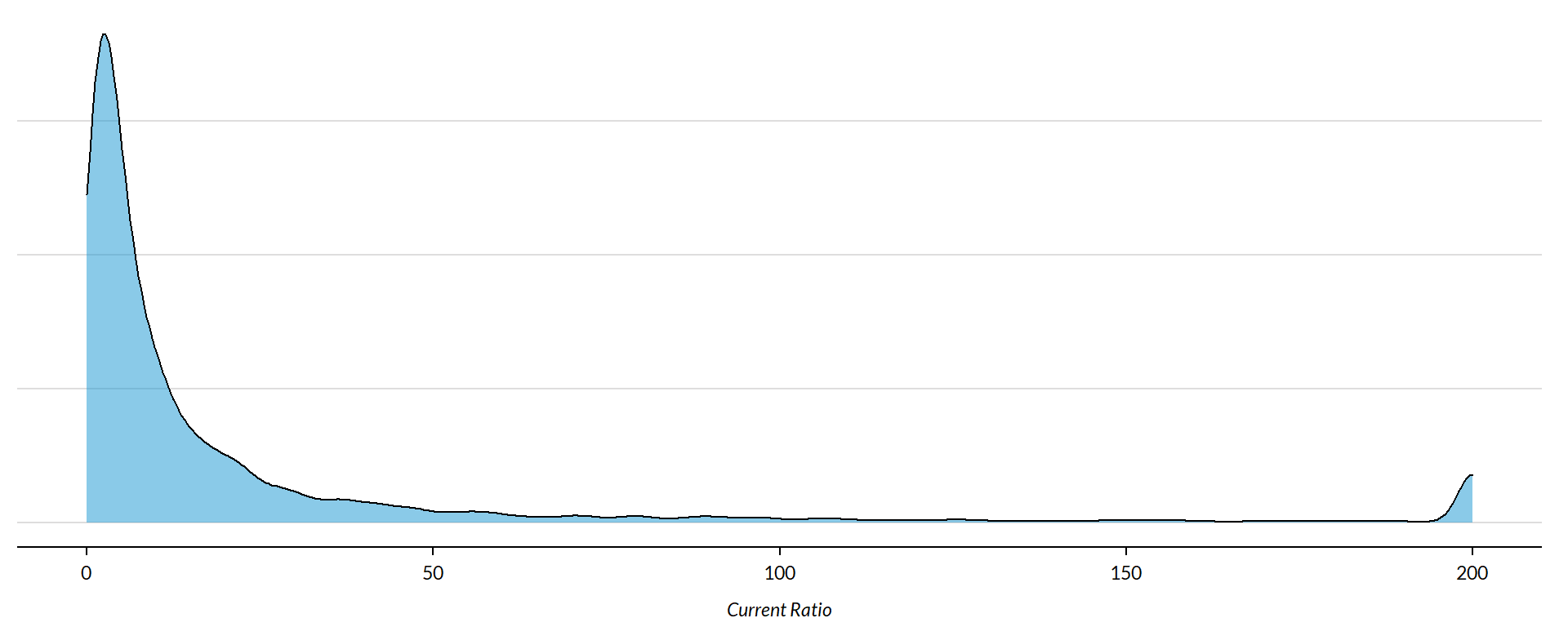

core2$currentratio[ core2$currentratio > 200 ] <- 200All values have been capped at the 95th percentile, or 200, to improve readability and exclude outliers. Negative values have been normalized to 0.

Metric Scope

Tax data is available for full 990 filers, so this metric does not describe any organizations with Gross receipts < $200,000 and Total assets < $500,000. Some organizations with receipts or assets below those thresholds may have filed a full 990, but these would be exceptions.

Descriptive Statistics

Convert all monetary variables to thousands of dollars.

core2 %>%

mutate( # currentratio = currentratio * 10000,

totrevenue = totrevenue / 1000,

totfuncexpns = totfuncexpns / 1000,

lndbldgsequipend = lndbldgsequipend / 1000,

totassetsend = totassetsend / 1000,

totliabend = totliabend / 1000,

totnetassetend = totnetassetend / 1000 ) %>%

select( STATE, NTEE1, NTMAJ12,

currentratio,

AGE,

totrevenue, totfuncexpns,

lndbldgsequipend, totassetsend,

totnetassetend, totliabend ) %>%

stargazer( type = s.type,

digits=0,

summary.stat = c("min","p25","median",

"mean","p75","max", "sd"),

covariate.labels = c("Current Ratio", "Age",

"Revenue ($1k)", "Expenses($1k)",

"Buildings ($1k)", "Total Assets ($1k)",

"Net Assets ($1k)", "Liabiliies ($1k)"))| Statistic | Min | Pctl(25) | Median | Mean | Pctl(75) | Max | St. Dev. |

| Current Ratio | 0 | 2 | 6 | 23 | 19 | 200 | 44 |

| Age | 3 | 22 | 30 | 32 | 41 | 95 | 15 |

| Revenue (1k) | -5,377 | 259 | 909 | 4,522 | 3,672 | 408,932 | 14,286 |

| Expenses(1k) | 0 | 263 | 840 | 4,192 | 3,328 | 382,667 | 13,466 |

| Buildings (1k) | -4 | 79 | 824 | 3,504 | 2,868 | 513,509 | 13,210 |

| Total Assets (1k) | -7,552 | 778 | 2,446 | 9,262 | 7,477 | 672,021 | 27,039 |

| Net Assets (1k) | -178,870 | 156 | 1,094 | 4,553 | 4,079 | 531,068 | 15,470 |

| Liabiliies (1k) | -2,707 | 115 | 816 | 4,709 | 3,133 | 705,623 | 18,722 |

What proportion of orgs have a Current Ratio of zero (no outstanding liabilities)?

prop.zero <- mean( core2$currentratio == 0, na.rm=T )In the sample, 1 percent of the organizations have a Current Ratio of zero, meaning they carried no short term debt. These organizations are dropped from subsequent graphs to keep the visualizations clean. The interpretation of the graphics should be the distributions of Current Ratio for organizations that carry short term debt.

Create quantile groups:

###

### ADD QUANTILES

###

### function create_quantiles() defined in r-functions.R

core2$exp.q <- create_quantiles( var=core2$totfuncexpns, n.groups=5 )

core2$rev.q <- create_quantiles( var=core2$totrevenue, n.groups=5 )

core2$asset.q <- create_quantiles( var=core2$totnetassetend, n.groups=5 )

core2$age.q <- create_quantiles( var=core2$AGE, n.groups=5 )

core2$land.q <- create_quantiles( var=core2$lndbldgsequipend, n.groups=5 )Current Ratio Density

min.x <- min( core2$currentratio, na.rm=T )

max.x <- max( core2$currentratio, na.rm=T )

ggplot( core2, aes(x = currentratio )) +

geom_density( alpha = 0.5) +

xlim( min.x, max.x ) +

xlab( variable.label ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

Current Ratio by NTEE Major Code

core3 <- core2 %>% filter( ! is.na(NTEE1) )

table( core3$NTEE1) %>% sort(decreasing=TRUE) %>% kable()| Var1 | Freq |

|---|---|

| Housing | 2837 |

| Community Development | 1585 |

| Human Services | 1102 |

t <- table( factor(core3$NTEE1) )

df <- data.frame( x=Inf, y=Inf,

N=paste0( "N=", as.character(t) ),

NTEE1=names(t) )

ggplot( core3, aes( x=currentratio ) ) +

geom_density( alpha = 0.5) +

# xlim( -0.1, 1 ) +

labs( title="Nonprofit Subsectors" ) +

xlab( variable.label ) +

facet_wrap( ~ NTEE1, nrow=1 ) +

theme_minimal( base_size = 15 ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank(),

strip.text = element_text( face="bold") ) + # size=20

geom_text( data=df,

aes(x, y, label=N ),

hjust=2, vjust=3,

color="gray60", size=6 )

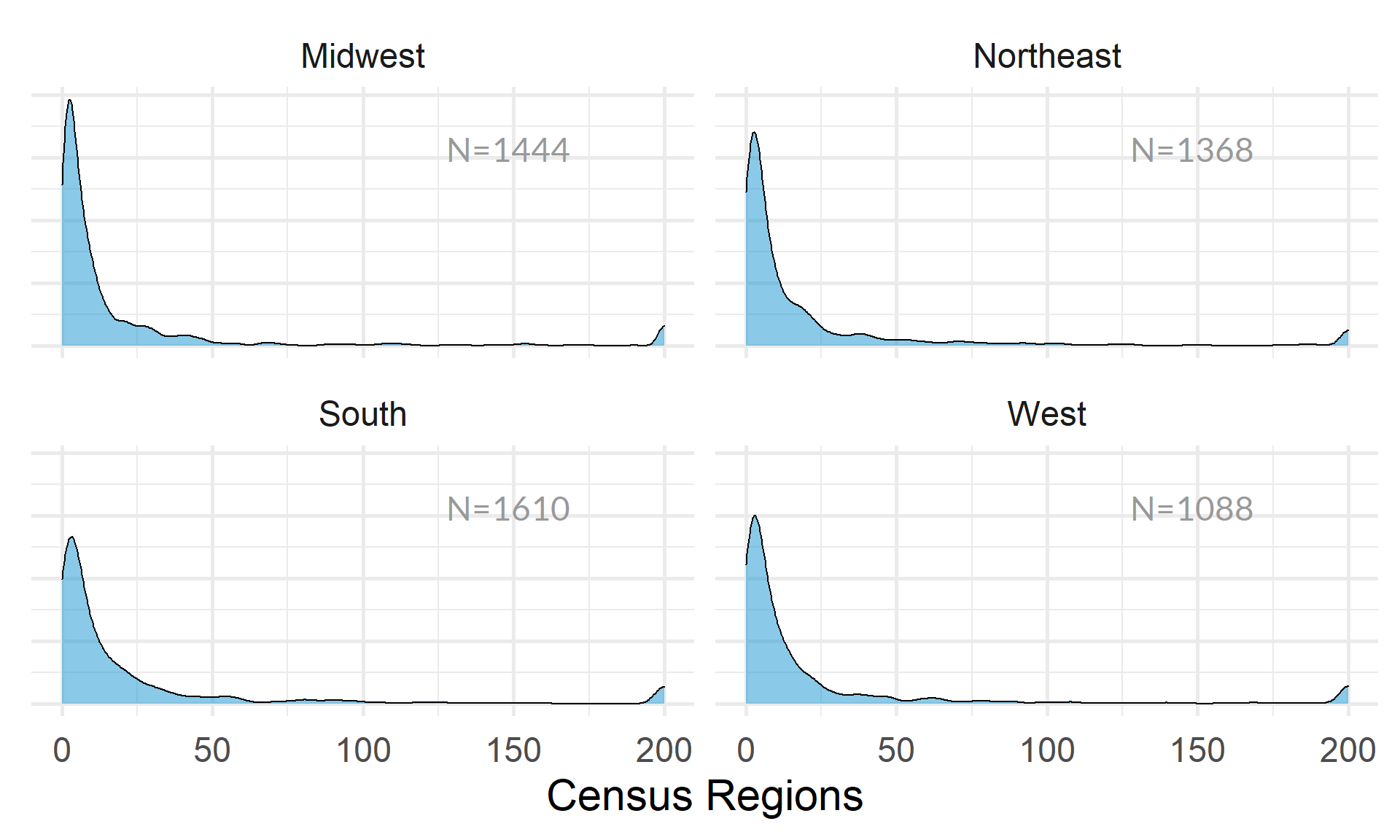

Current Ratio by Region

table( core2$Region) %>% kable()| Var1 | Freq |

|---|---|

| Midwest | 1444 |

| Northeast | 1368 |

| South | 1610 |

| West | 1088 |

t <- table( factor(core2$Region) )

df <- data.frame( x=Inf, y=Inf,

N=paste0( "N=", as.character(t) ),

Region=names(t) )

core2 %>%

filter( ! is.na(Region) ) %>%

ggplot( aes(currentratio) ) +

geom_density( alpha = 0.5) +

xlab( "Census Regions" ) +

ylab( variable.label ) +

facet_wrap( ~ Region, nrow=3 ) +

theme_minimal( base_size = 22 ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() ) +

geom_text( data=df,

aes(x, y, label=N ),

hjust=2, vjust=3,

color="gray60", size=6 )

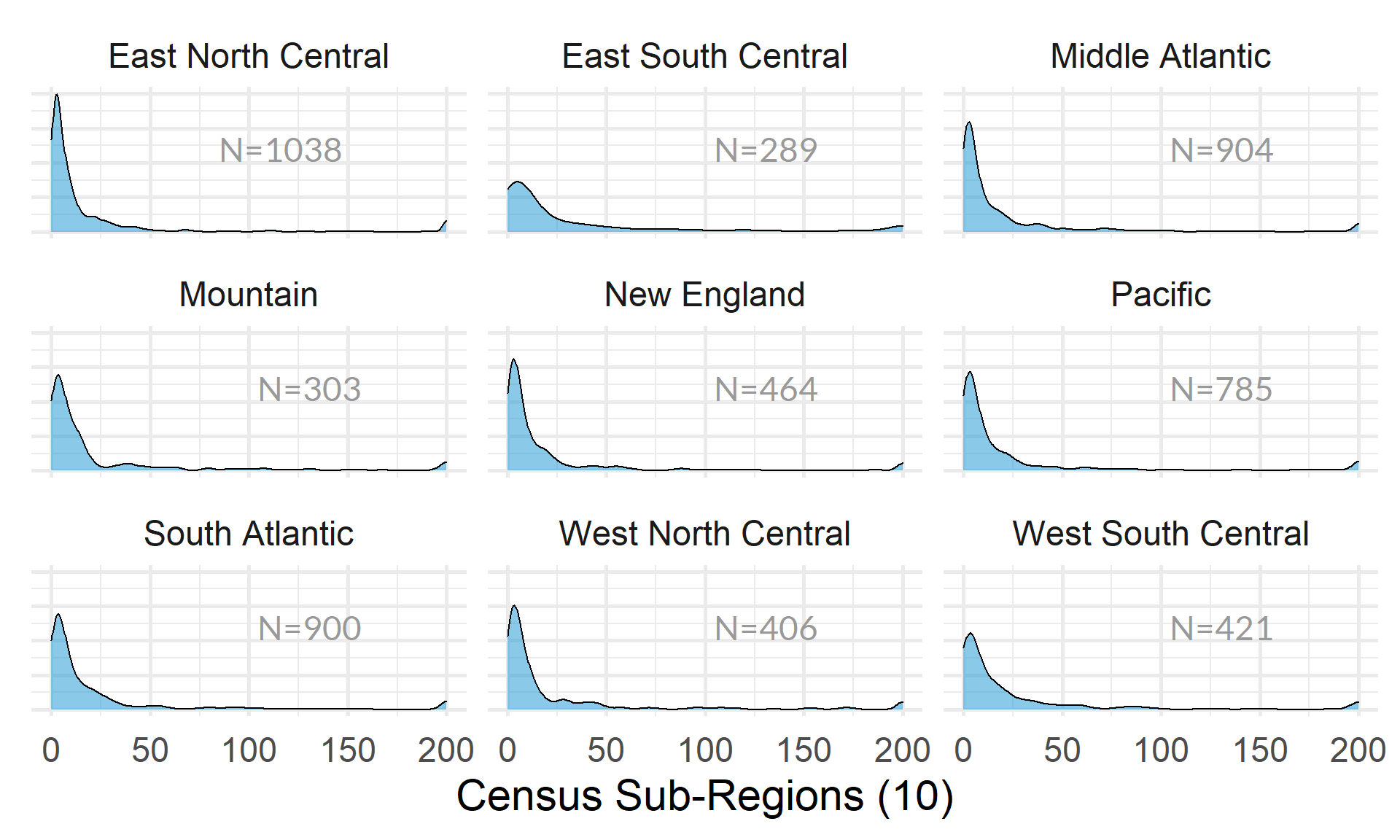

table( core2$Division ) %>% kable()| Var1 | Freq |

|---|---|

| East North Central | 1038 |

| East South Central | 289 |

| Middle Atlantic | 904 |

| Mountain | 303 |

| New England | 464 |

| Pacific | 785 |

| South Atlantic | 900 |

| West North Central | 406 |

| West South Central | 421 |

t <- table( factor(core2$Division) )

df <- data.frame( x=Inf, y=Inf,

N=paste0( "N=", as.character(t) ),

Division=names(t) )

core2 %>%

filter( ! is.na(Division) ) %>%

ggplot( aes(currentratio) ) +

geom_density( alpha = 0.5 ) +

xlab( "Census Sub-Regions (10)" ) +

ylab( variable.label ) +

facet_wrap( ~ Division, nrow=3 ) +

theme_minimal( base_size = 22 ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() ) +

geom_text( data=df,

aes(x, y, label=N ),

hjust=2, vjust=3,

color="gray60", size=6 )

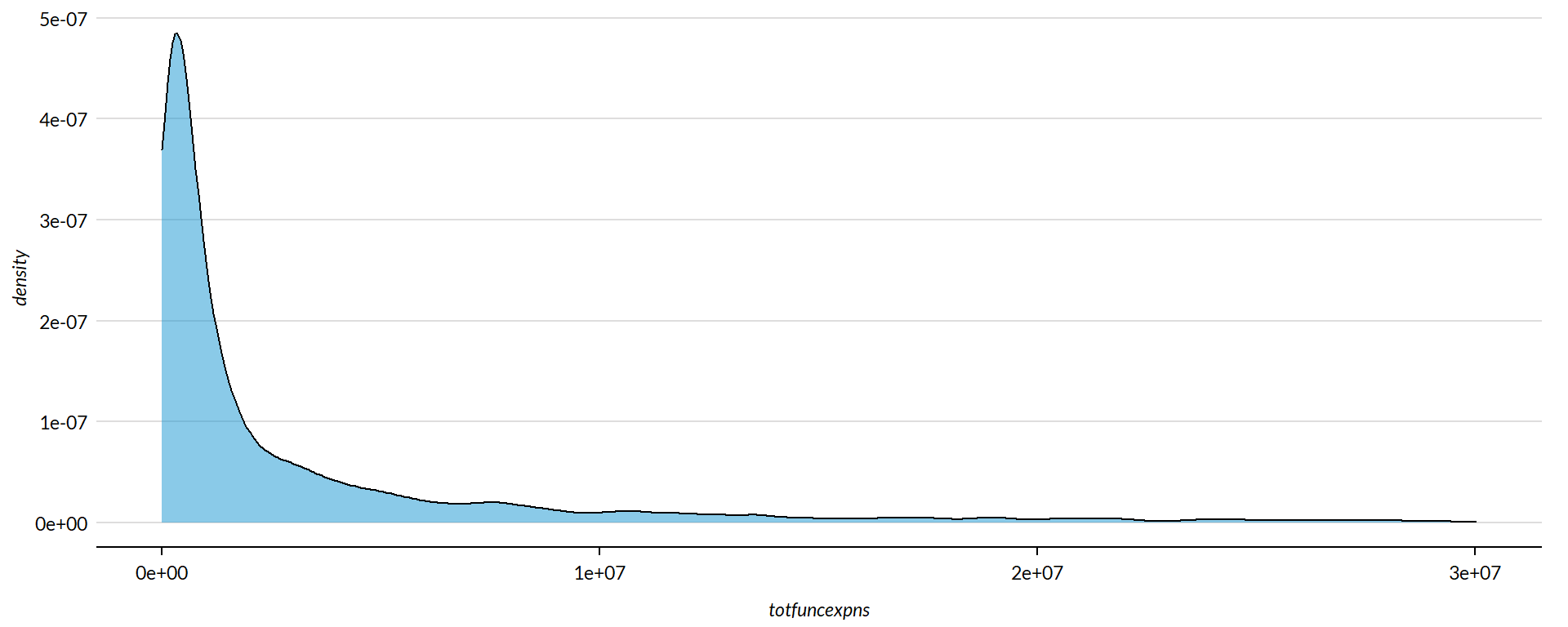

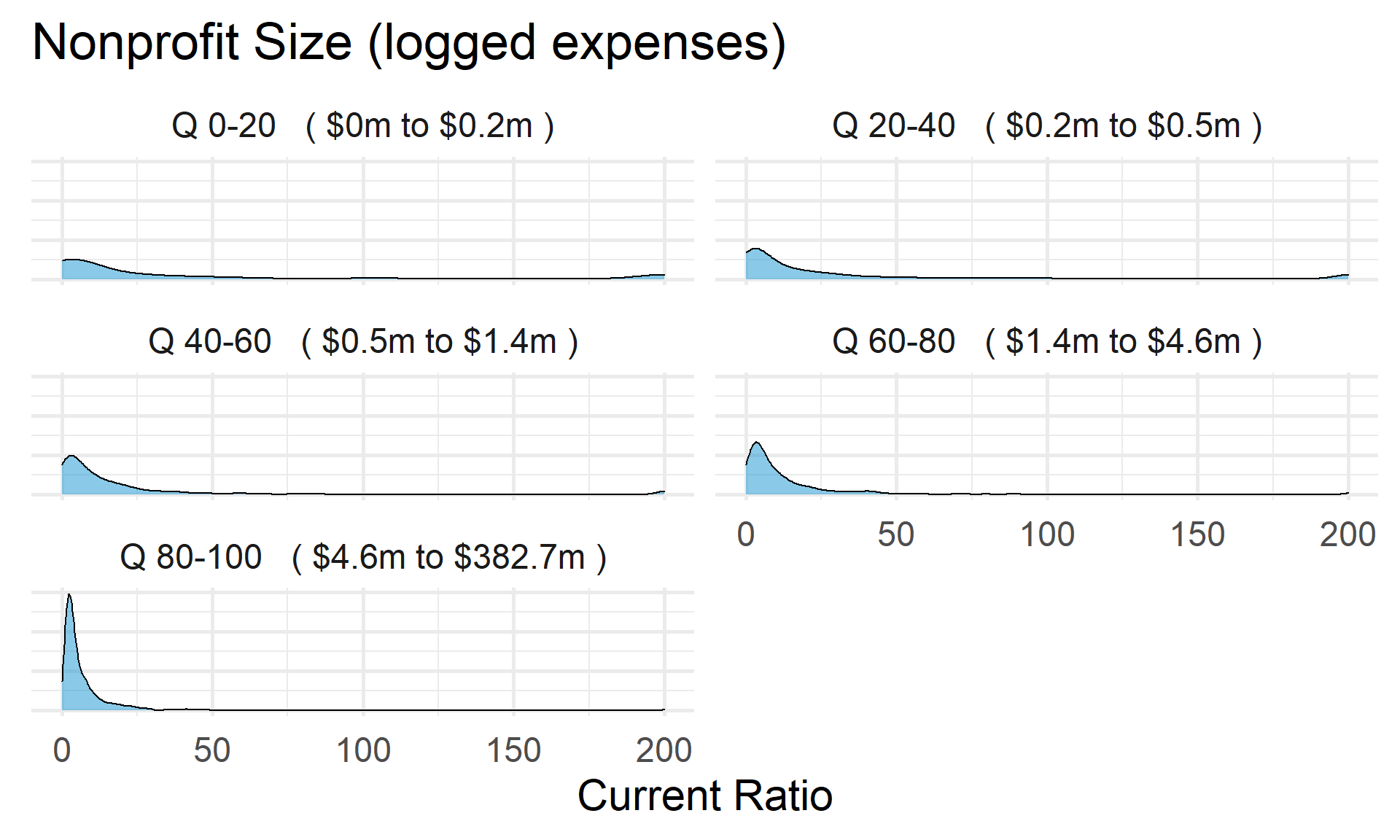

Current Ratio by Nonprofit Size (Expenses)

ggplot( core2, aes(x = totfuncexpns )) +

geom_density( alpha = 0.5 ) +

xlim( quantile(core2$totfuncexpns, c(0.02,0.98), na.rm=T ) )

core2$totfuncexpns[ core2$totfuncexpns < 1 ] <- 1

# core2$totfuncexpns[ is.na(core2$totfuncexpns) ] <- 1

if( nrow(core2) > 10000 )

{

core3 <- sample_n( core2, 10000 )

} else

{

core3 <- core2

}

jplot( log10(core3$totfuncexpns), core3$currentratio,

xlab="Nonprofit Size (logged Expenses)",

ylab=variable.label,

xaxt="n", xlim=c(3,10) )

axis( side=1,

at=c(3,4,5,6,7,8,9,10),

labels=c("1k","10k","100k","1m","10m","100m","1b","10b") )

core2 %>%

filter( ! is.na(exp.q) ) %>%

ggplot( aes(currentratio) ) +

geom_density( alpha = 0.5 ) +

labs( title="Nonprofit Size (logged expenses)" ) +

xlab( variable.label ) +

facet_wrap( ~ exp.q, nrow=3 ) +

theme_minimal( base_size = 22 ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

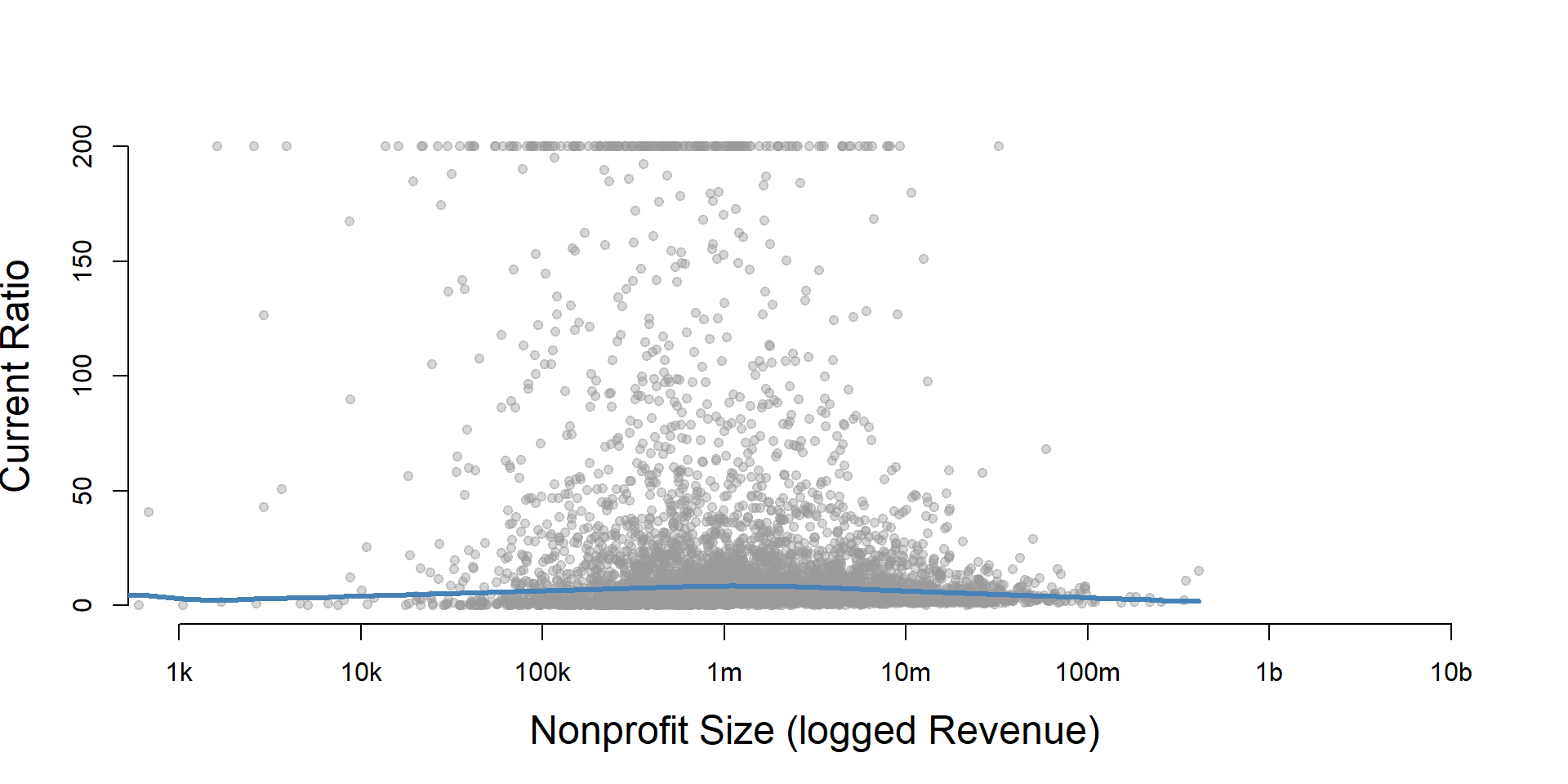

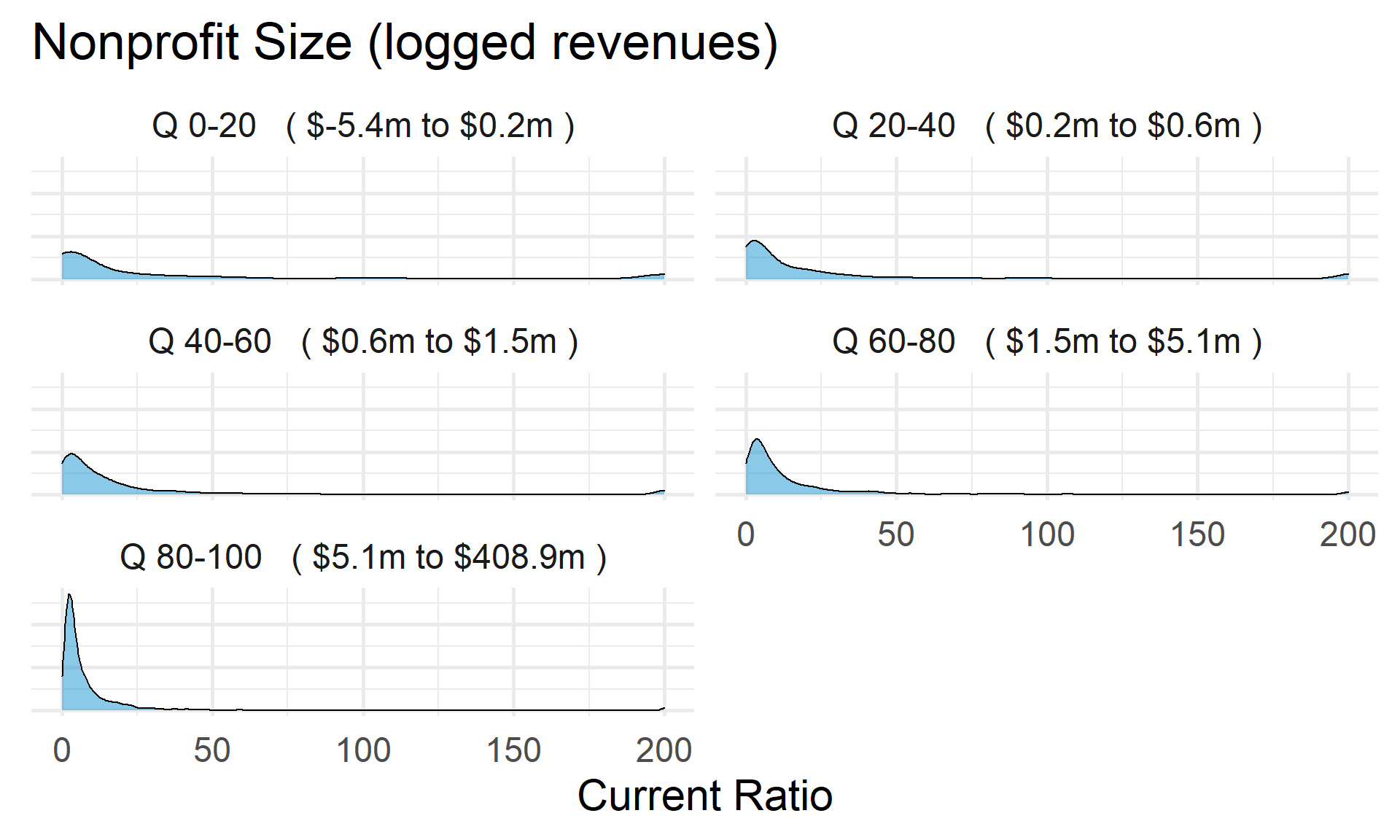

Current Ratio by Nonprofit Size (Revenue)

ggplot( core2, aes(x = totrevenue )) +

geom_density( alpha = 0.5 ) +

xlim( quantile(core2$totrevenue, c(0.02,0.98), na.rm=T ) ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

core2$totrevenue[ core2$totrevenue < 1 ] <- 1

if( nrow(core2) > 10000 )

{

core3 <- sample_n( core2, 10000 )

} else

{

core3 <- core2

}

jplot( log10(core3$totrevenue), core3$currentratio,

xlab="Nonprofit Size (logged Revenue)",

ylab=variable.label,

xaxt="n", xlim=c(3,10) )

axis( side=1,

at=c(3,4,5,6,7,8,9,10),

labels=c("1k","10k","100k","1m","10m","100m","1b","10b") )

core2 %>%

filter( ! is.na(rev.q) ) %>%

ggplot( aes(currentratio) ) +

geom_density( alpha = 0.5 ) +

labs( title="Nonprofit Size (logged revenues)" ) +

xlab( variable.label ) +

facet_wrap( ~ rev.q, nrow=3 ) +

theme_minimal( base_size = 22 ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

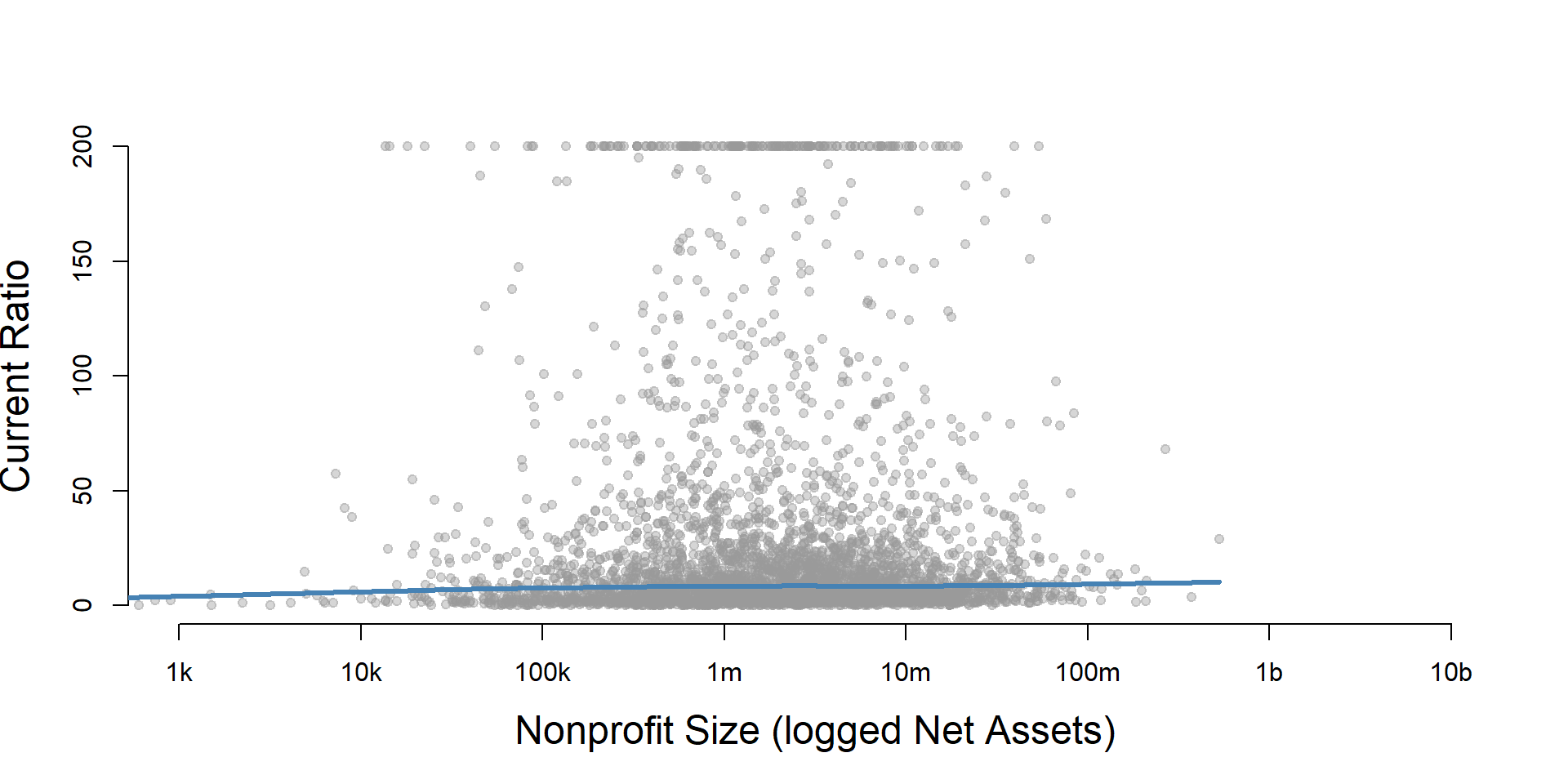

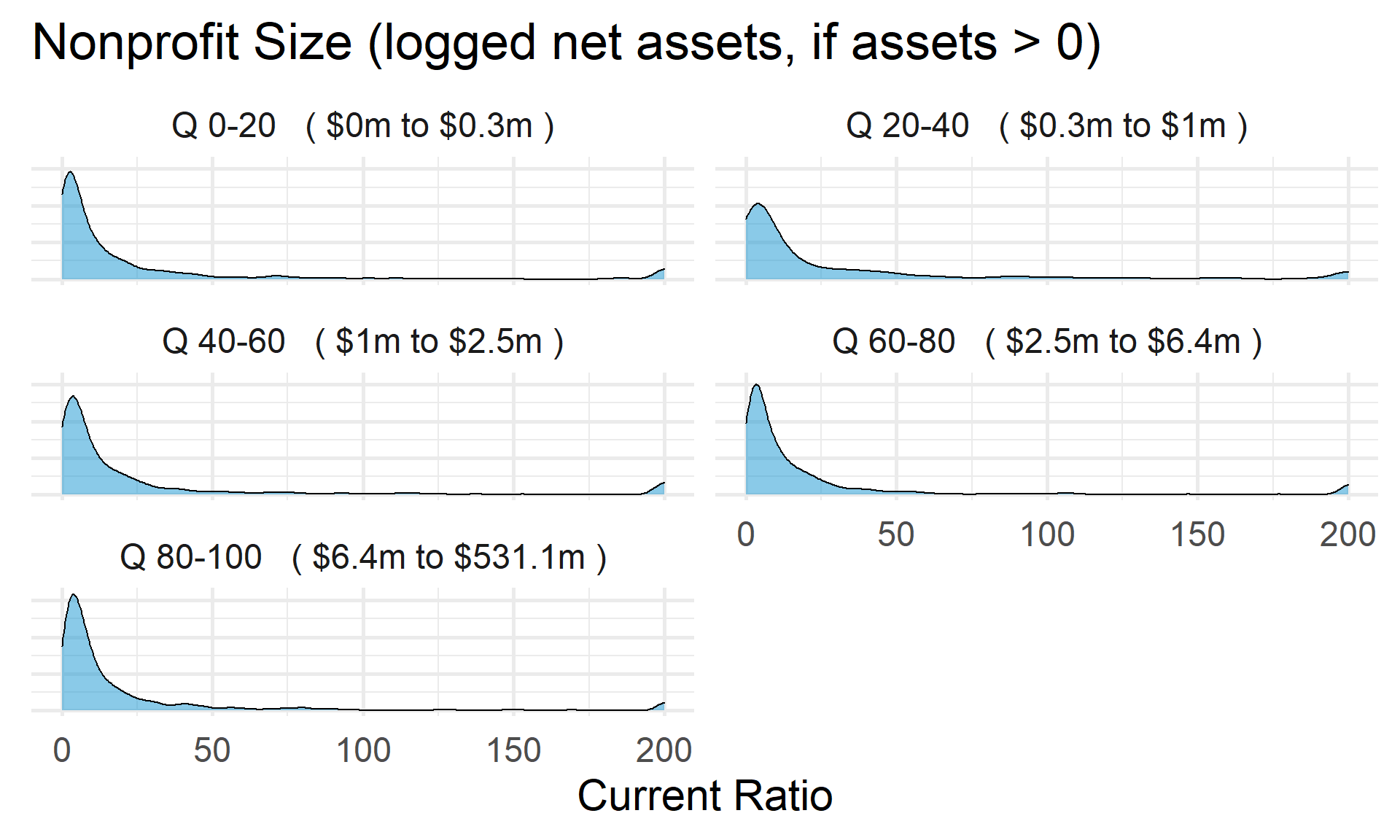

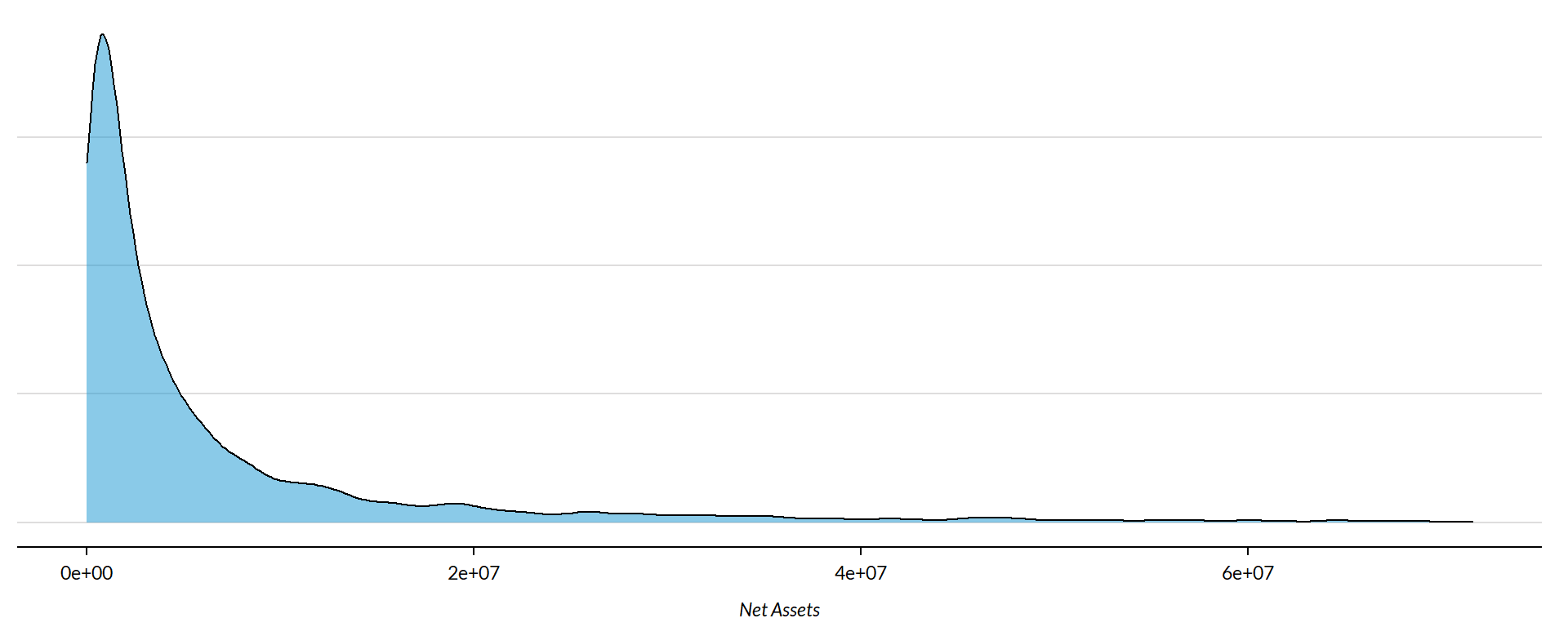

Current Ratio by Nonprofit Size (Net Assets)

ggplot( core2, aes(x = totnetassetend )) +

geom_density( alpha = 0.5 ) +

xlim( quantile(core2$totnetassetend, c(0.02,0.98), na.rm=T ) ) +

xlab( "Net Assets" ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

core2$totnetassetend[ core2$totnetassetend < 1 ] <- NA

if( nrow(core2) > 10000 )

{

core3 <- sample_n( core2, 10000 )

} else

{

core3 <- core2

}

jplot( log10(core3$totnetassetend), core3$currentratio,

xlab="Nonprofit Size (logged Net Assets)",

ylab=variable.label,

xaxt="n", xlim=c(3,10) )

axis( side=1,

at=c(3,4,5,6,7,8,9,10),

labels=c("1k","10k","100k","1m","10m","100m","1b","10b") )

core2$totnetassetend[ core2$totnetassetend < 1 ] <- NA

core2$asset.q <- create_quantiles( var=core2$totnetassetend, n.groups=5 )

core2 %>%

filter( ! is.na(asset.q) ) %>%

ggplot( aes(currentratio) ) +

geom_density( alpha = 0.5 ) +

labs( title="Nonprofit Size (logged net assets, if assets > 0)" ) +

xlab( variable.label ) +

ylab( "" ) +

facet_wrap( ~ asset.q, nrow=3 ) +

theme_minimal( base_size = 22 ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

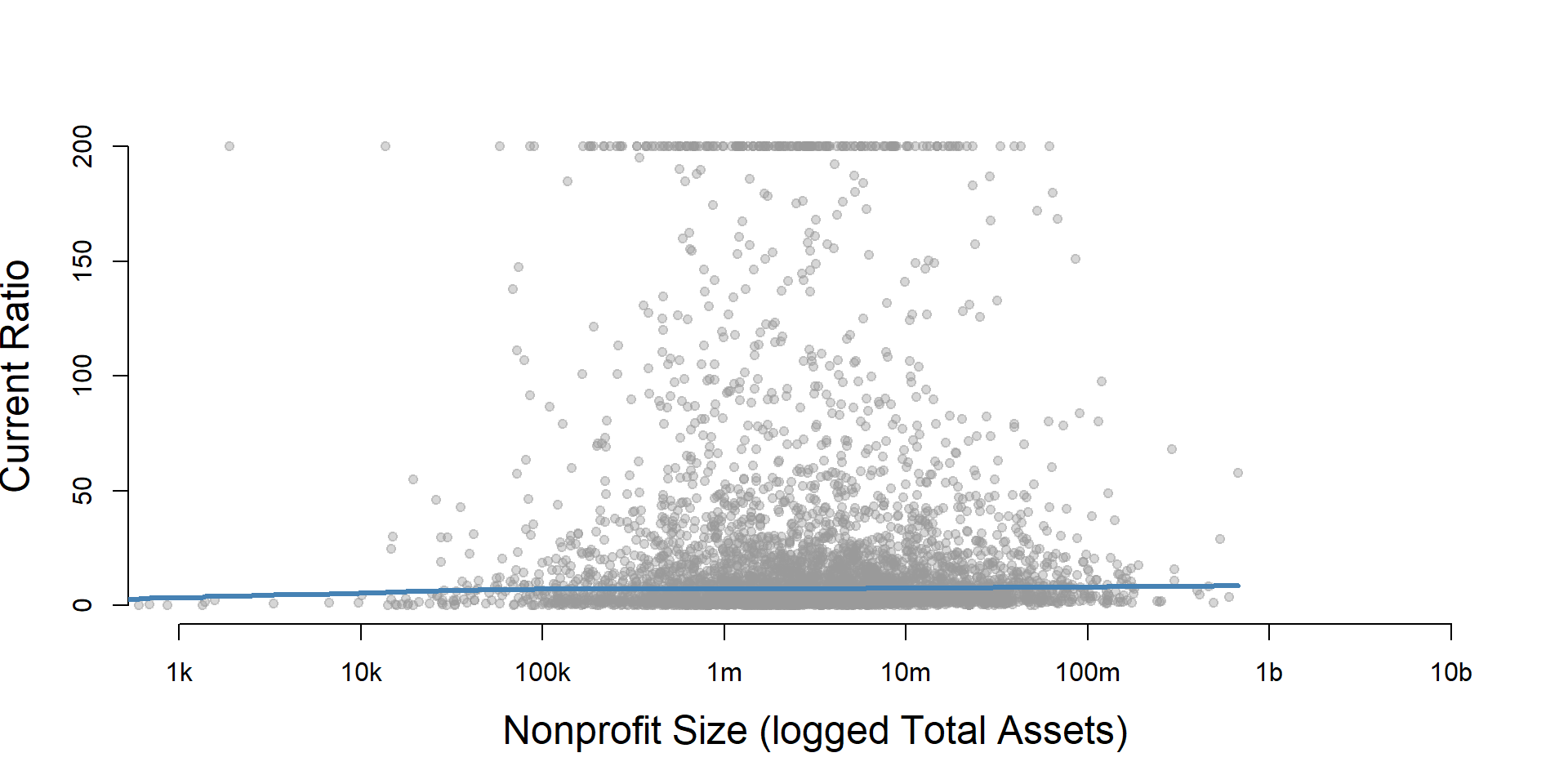

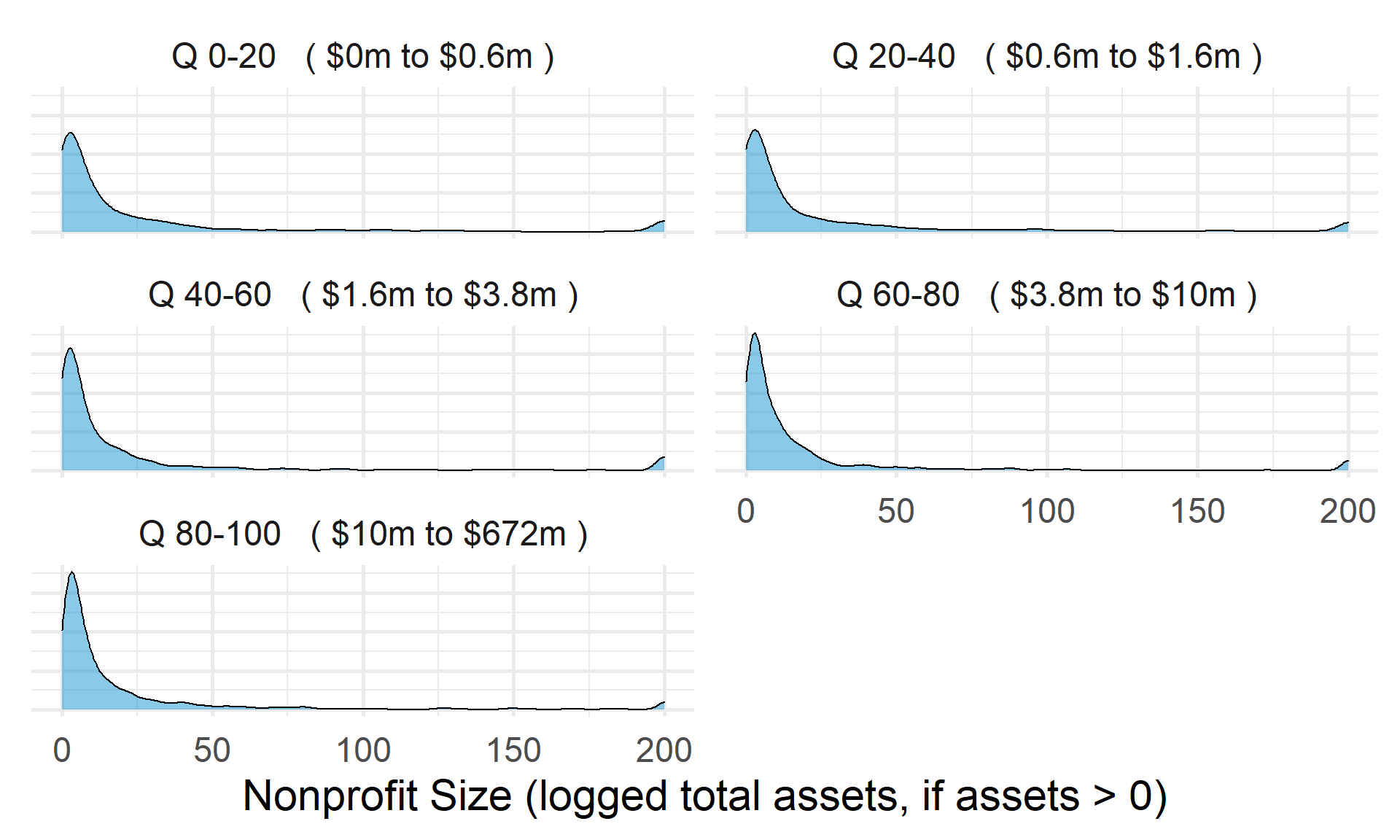

Total Assets for Comparison

core2$totassetsend[ core2$totassetsend < 1 ] <- NA

core2$tot.asset.q <- create_quantiles( var=core2$totassetsend, n.groups=5 )

if( nrow(core2) > 10000 )

{

core3 <- sample_n( core2, 10000 )

} else

{

core3 <- core2

}

jplot( log10(core3$totassetsend), core3$currentratio,

xlab="Nonprofit Size (logged Total Assets)",

ylab=variable.label,

xaxt="n", xlim=c(3,10) )

axis( side=1,

at=c(3,4,5,6,7,8,9,10),

labels=c("1k","10k","100k","1m","10m","100m","1b","10b") )

ggplot( core2, aes(x = totassetsend )) +

geom_density( alpha = 0.5 ) +

xlim( quantile(core2$totassetsend, c(0.02,0.98), na.rm=T ) ) +

xlab( "Net Assets" ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

core2 %>%

filter( ! is.na(tot.asset.q) ) %>%

ggplot( aes(currentratio) ) +

geom_density( alpha = 0.5 ) +

xlab( "Nonprofit Size (logged total assets, if assets > 0)" ) +

ylab( variable.label ) +

facet_wrap( ~ tot.asset.q, nrow=3 ) +

theme_minimal( base_size = 22 ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

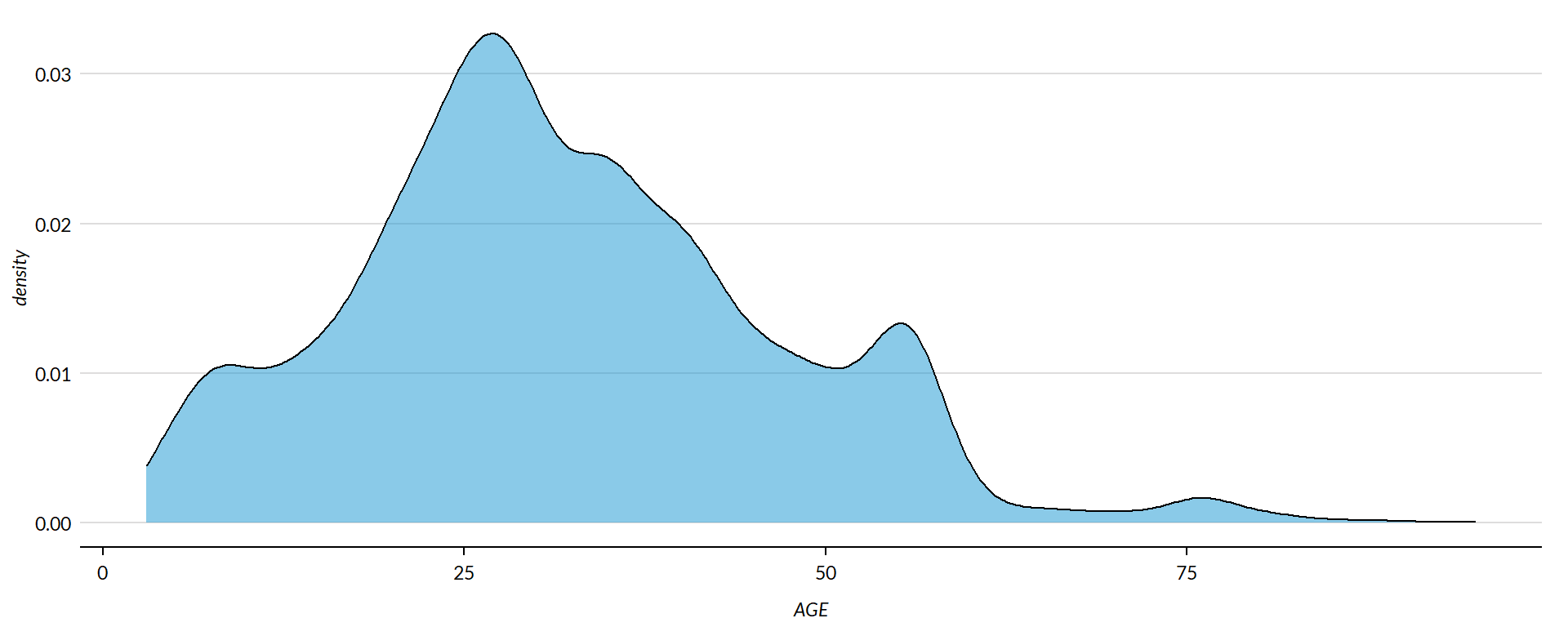

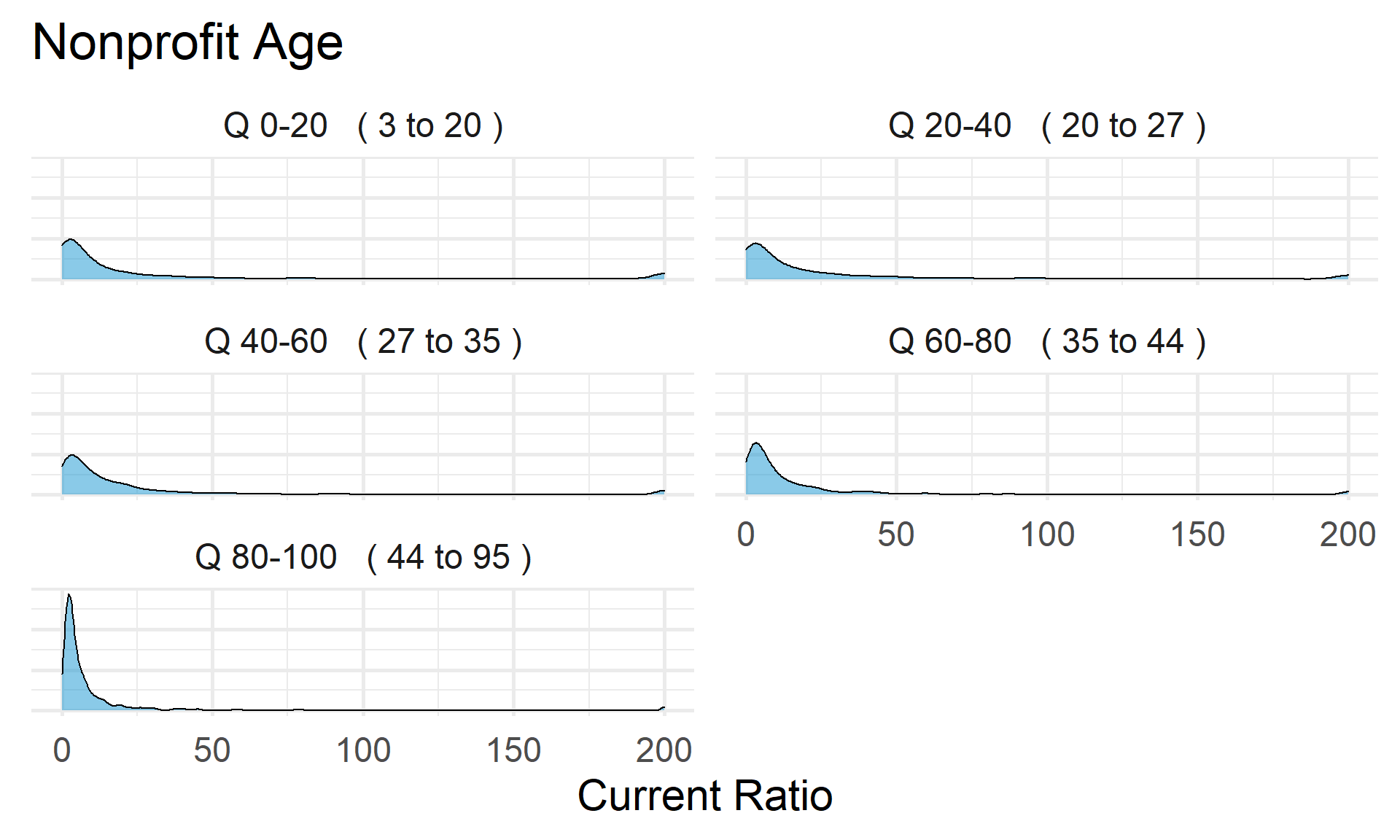

Current Ratio by Nonprofit Age

ggplot( core2, aes(x = AGE )) +

geom_density( alpha = 0.5 )

core2$AGE[ core2$AGE < 1 ] <- NA

if( nrow(core2) > 10000 )

{

core3 <- sample_n( core2, 10000 )

} else

{

core3 <- core2

}

jplot( core3$AGE, core3$currentratio,

xlab="Nonprofit Age",

ylab=variable.label )

core2 %>%

filter( ! is.na(age.q) ) %>%

ggplot( aes(currentratio) ) +

geom_density( alpha = 0.5) +

labs( title="Nonprofit Age" ) +

xlab( variable.label ) +

ylab( "" ) +

facet_wrap( ~ age.q, nrow=3 ) +

theme_minimal( base_size = 22 ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

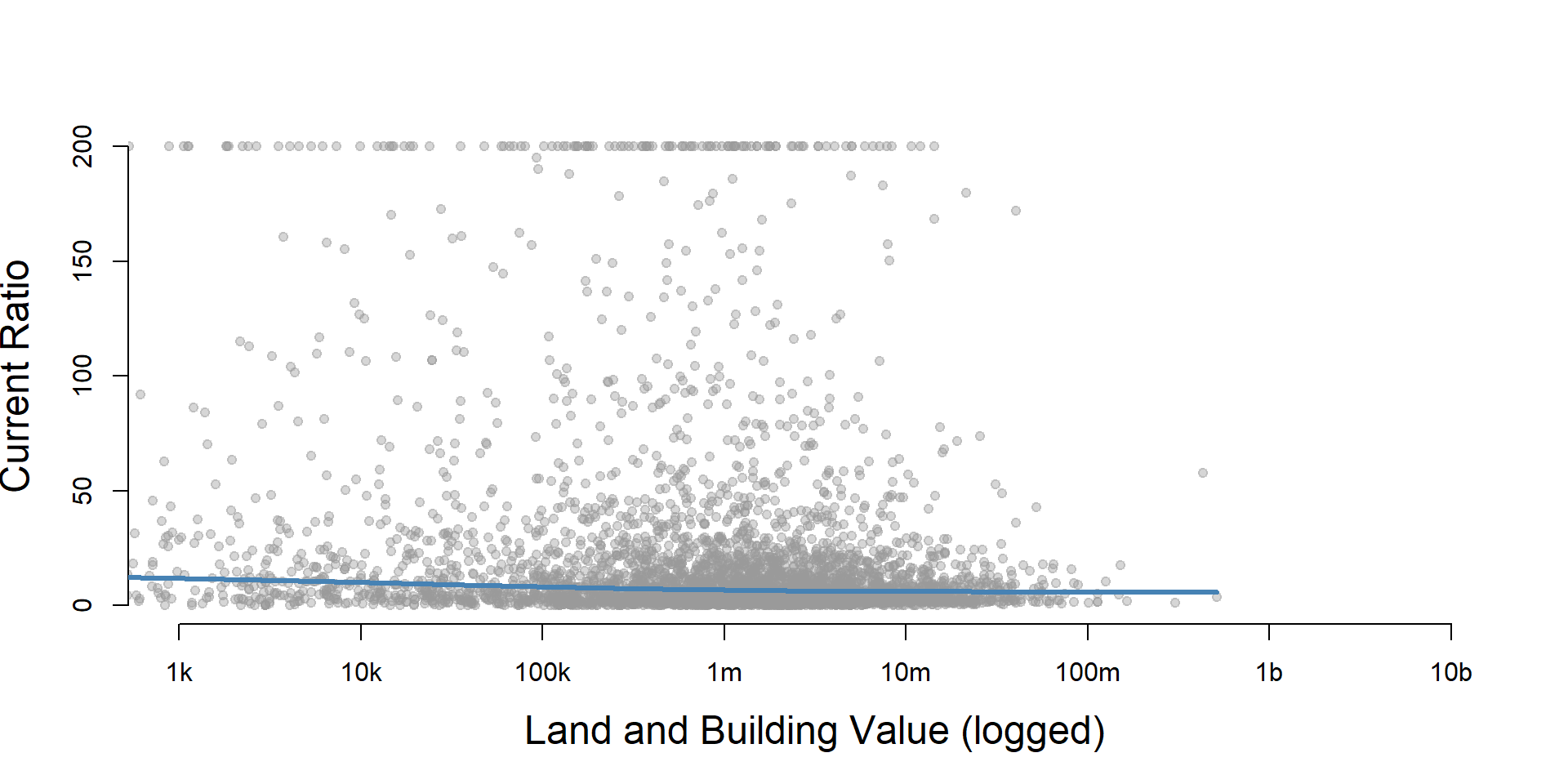

Current Ratio by Land and Building Value

ggplot( core2, aes(x = lndbldgsequipend )) +

geom_density( alpha = 0.5 )

core2$lndbldgsequipend[ core2$lndbldgsequipend < 1 ] <- NA

if( nrow(core2) > 10000 )

{

core3 <- sample_n( core2, 10000 )

} else

{

core3 <- core2

jplot( log10(core3$lndbldgsequipend), core3$currentratio,

xlab="Land and Building Value (logged)",

ylab=variable.label,

xaxt="n", xlim=c(3,10) )

axis( side=1,

at=c(3,4,5,6,7,8,9,10),

labels=c("1k","10k","100k","1m","10m","100m","1b","10b") )

}

core2 %>%

filter( ! is.na(land.q) ) %>%

ggplot( aes(currentratio) ) +

geom_density( alpha = 0.5 ) +

labs( title="Land and Building Value" ) +

xlab( variable.label ) +

ylab( "" ) +

facet_wrap( ~ land.q, nrow=3 ) +

theme_minimal( base_size = 22 ) +

theme( axis.title.y=element_blank(),

axis.text.y=element_blank(),

axis.ticks.y=element_blank() )

Save Metrics

core.currentratio <- select( core, ein, tax_pd, currentratio )

saveRDS( core.currentratio, "03-data-ratios/m-02-current-ratio.rds" )

write.csv( core.currentratio, "03-data-ratios/m-02-current-ratio.csv" )